Fake bank statement for loan verification#

However, some regions are more likely to legally mandate address verification than others. Proof of occupancy is a basic requirement for KYC/KYB and AML compliance in most jurisdictions. As you add verification methods to stay compliant with KYC, KYB, AML, and mortgage lending regulations, you weed out security threats, minimize fraud risks, avoid legal complications, and confidently expand your customer base at the same time. There are ways to avoid the costs of fraud, and it starts with following identity regulations. Think of it like this: as online transactions increase in value, so does the risk of fraud and thereby the need for security. High-value eCommerce transactions also need occupancy verification so that, for example, a car or expensive piece of equipment doesn’t get sent to the wrong place.

To mitigate fraud and default risks, FHA, VA, and USDA borrowers must provide lenders with documents to verify that they are using newly purchased properties as their primary residence. Mortgage lenders also depend on occupancy verification to ensure loan requirements are being met. Online rental platforms aren’t the only digital services that require proof of address. Because Airbnb didn’t properly verify that hosts lived where they said they lived, hosts could list a property down the street as the rental, only to reveal an inferior space as the real address later. Within the past year or so, Airbnb has experienced a rise in fictitious hosts – causing customers to get scammed out of multiple housing properties. Let’s look at Airbnb, the online platform that facilitates the process of booking private living spaces for travelers, as a use case. Proving consumers’ addresses is an efficient way for businesses like mortgage lenders, eCommerce stores, online marketplaces, and online gaming and gambling sites to be absolutely sure of their customers’ identities. In order to fully understand the importance of verifying your customers’ addresses, we need only look at the variety of different industries that benefit. Why is proof of address a necessity? Dodge avoidable risks One place to start is with safer, more secure proof of address verification.

Fake bank statement for loan software#

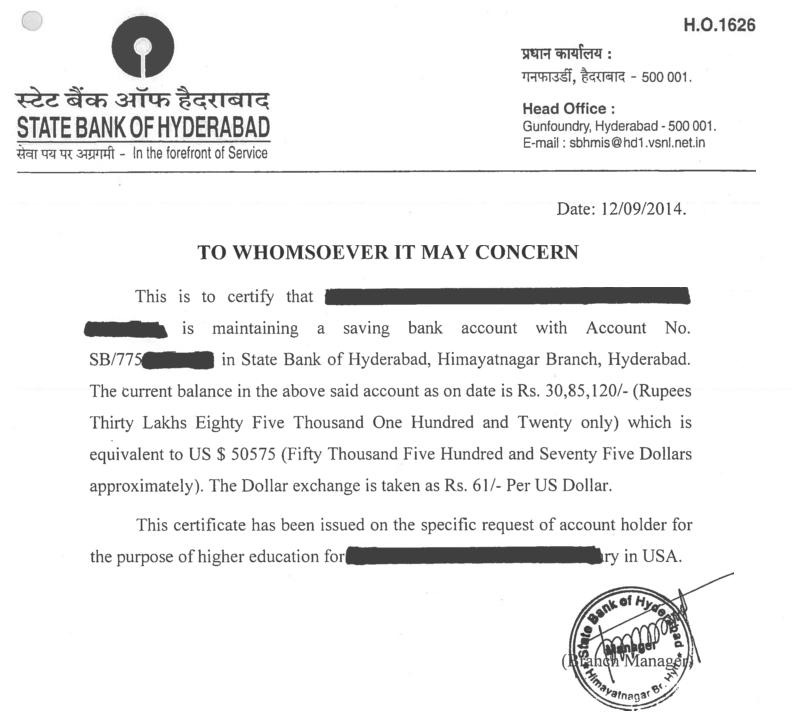

To reduce these losses and mitigate identity theft risk, identity, and loan origination software platforms need better ways to protect their lending and eCommerce customers. Additionally, loan account fraud surged from $400 million to $3.4 billion in 2019, and banks and credit unions are losing money to synthetic identity fraud. Since the start of the pandemic, the FTC has received four times as many identity theft complaints in April than in January through March combined.

0 kommentar(er)

0 kommentar(er)